|

Replies: 79

| visibility 4891

|

Ultimate Clemson Legend [108654]

TigerPulse: 100%

64

Posts: 70535

Joined: 2002

|

What happens when you start to question something that shall not be questioned?

May 21, 2025, 4:00 AM

|

|

Not sure, but we may be about to find out.

|

|

|

|

|

Clemson Icon [26478]

TigerPulse: 100%

54

Posts: 17831

Joined: 2024

|

Re: What happens when you start to question something that shall not be questioned?

May 21, 2025, 6:19 AM

|

|

So what does that mean and what are are you think could possibly happen?

|

|

|

|

|

|

Clemson Sports Icon [57934]

TigerPulse: 100%

59

Posts: 27283

Joined: 1999

|

Re: What happens when you start to question something that shall not be questioned?

1

May 21, 2025, 6:31 AM

|

|

|

|

|

|

|

|

Ring of Honor [22298]

TigerPulse: 100%

53

Posts: 17529

Joined: 1998

|

|

|

|

|

|

TigerNet Champion [118100]

TigerPulse: 100%

65

Posts: 69251

Joined: 2002

|

Re: Trumps One Big Beautiful DEBT Bill may not good for Merica***

1

May 21, 2025, 9:02 AM

|

|

|

|

|

|

|

|

TigerNet Champion [118100]

TigerPulse: 100%

65

Posts: 69251

Joined: 2002

|

|

|

|

|

|

TigerNet Champion [118100]

TigerPulse: 100%

65

Posts: 69251

Joined: 2002

|

|

|

|

|

|

TigerNet Champion [118100]

TigerPulse: 100%

65

Posts: 69251

Joined: 2002

|

|

|

|

|

|

Ultimate Clemson Legend [108654]

TigerPulse: 100%

64

Posts: 70535

Joined: 2002

|

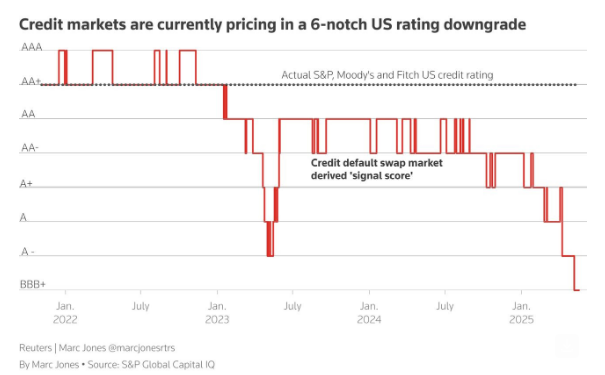

It's not real good. Credit default swaps on US debt are rising to levels

1

May 21, 2025, 8:48 AM

[ in reply to Re: What happens when you start to question something that shall not be questioned? ] |

|

that would suggest the debt is already at a downgrade. The vultures of our financial system are the hedge funds and others who buy CDS (credit default swaps). They circle when they smell a carcass, and are often the first sign of a problem. The markets and ratings agencies will be perhaps the very last signs of a problem.

Way back in the day, the ratings agencies rated most mortgage backed securities (MBS) as AAA. A few were AA. Hardly any were B or below. And from 2003 until 2008, they kept rating MBS as AAA, KNOWING they were full of crap sub-prime mortgages. They kept that AAA rating until the securities literally collapsed. The same people, the Michael Burry types, who literally had to invent a CDS market on MBS, those types are now betting against US debt, instead of mortgage debt.

Our national debt has been on an unsustainable track for decades, ever since Ross Perot ran for president, and before that even. And yet, only recently did Moody's downgrade US debt from the very top level. Others had downgraded it a TOUCH for over a decade. And if the credit ratings agencies drop a rating, you can assume the actual rating is far worse.

Switching gears, our debt is $36.8T. The higher our debt goes, the more sensitive it is to inflation and interest rates, the less inflation it takes to reach insolvency. As it grows, the level of inflation required to make us insolvent declines. We have about $4.9T in federal revenues each year, then 6+T of expenses, $1T or more being interest payments on our debt. Government spending has risen 25%+ since we had that bout of inflation, and most of that is simply in higher interest payments.

Enter Trump, and his tariffs. It is about the LAST thing anyone would ever want to do if you're in the debt situation we're in. What MAY be happening is the short sellers, the vultures, they probably know the truth that even the most skeptic tariff economists likely ignore because it's quantitatively unknown, and speculative at best, and is so bad that thinking about it would suck.

We have a trade deficit for a reason. We import more than we export, for a reason. How does a nation with 330 million potential human labor units, CONSUME more labor and resources than 3.5 billion other potential human labor units on this planet? Easy, you farm off excess labor, using dollars to leverage the labor and supply chains. Take China as an example. Trump has currently what a 30% tariff rate with them? We have just under a $300 BILLION trade deficit with China, prior to tariffs.

Now, every single American dollar sent overseas to BUY something, that is shipped back to the US, that dollar sent is multiplied in labor, to varying degrees based on currency disparities. For China, it's roughly 4 to 1. For every dollar we send to China to build/make something, we are shipped $4 worth of Chinese labor and products. The average Chinaman makes $16K a year in dollars. Average American makes $65K....roughly 400% more. So we SAVE 400% (minus shipping) making the product in China for US consumers to buy inside the US. They also have 4x the labor force to make stuff over the US, and do it 4x cheaper.

So.....when you add a 10% tariff to the goods as they're imported, you're adding essentially a 10% premium on top of 400% labor returned. Keep in mind the tariffs are taken at the ports, upon import, and are based on the market value of the product being imported in DOMESTIC dollars for domestic consumers. The margins of labor to dollars varies by country. Mexico is roughly 8-1. Vietnam is far higher than that, around 40-1. People who don't understand the labor part of the equation, and only see dollars (eg. Trump & Co), they will not take the labor into account at all, but they are taxing FAR more labor than they realize.

Because of this ignored LABOR part of the tariff equation, we stand a chance to see the "minor" inflationary pressure tariffs cause, to be multiplied due to the strength of our dollar. So when we import $500 billion in goods each year from China, we are importing $2 TRILLION in GDP. Or, likewise, the equivalent of $2 TRILLION in US domestic labor, that Trump wants to bring back to the US?

Second aspect, we lack the human capital (LABOR) to offset lost imports. We simply don't have the labor capacity to absorb the jobs we farm off to ChinaVietnamMexicoEtc. We have more dollars, a stronger economy, than we have the labor to support, without outlets like imports and illegal domestic workers. If you kick out all the illegals, and balance our trade, we will have SIGNIFICANT inflation, far higher than the MAGA crowd expects, and that magic inflation number needed to SINK OUR DOLLAR/ECONOMY/GOVERNMENT will shrink dramatically. Was 12%, then dropped to about 10%, could be as low as 8% now. The current fed lending rate, based on low inflation, is at 4.5%. And with this, we're paying $1T in interest yearly. At 8%, we pay $2T servicing debt, ON TOP of the deficits we already run. At 10% inflation on imports, IF THAT IS MULTIPLIED due to the labor aspect of the equation, then you can easily see that 10% tariff multiplied, making overall inflation go up more than expected. When you add 10% to the $4.4T part of our economy and GDP that is comprised by imports, and that 10% is multiplied by dollar leveraging, your tariff impact will be magnified far more than 10%, cascading into other areas driving up overall inflation far more than expected.

This is what the hedge fund guys are betting on, and I think they are likely onto something. The federal Reserve is already stepping in and buying treasuries as the market for US debt is contracting and the dollar is weakening. They're trying desperately to keep that 10yr bond yield below 5%, because that is what mortgage rates follow. That's why mortgage rates are rising now, and are at 7% now, and will keep rising no matter what Powell does with the interest rates, because the dollar is tanking.

If I wanted to collapse the US economy, and render the governemnt insolvent, and possibly start a revolution and become king, I'd do just what Trump is doing. Trump plowed into his economic policy under the assumption the dollar was supreme, and would remain supreme. He's wrong on that. By design or ignorance? Does it matter?

|

|

|

|

|

|

TigerNet Champion [118100]

TigerPulse: 100%

65

Posts: 69251

Joined: 2002

|

Thanks ChatGPT

4

May 21, 2025, 9:01 AM

|

|

I found a use for AI, interpreting Tiggity posts.

Summary:

The article argues that the U.S. economy is in a precarious position, evidenced by rising credit default swap (CDS) prices on U.S. debt—signaling investor concerns akin to a debt downgrade. The author draws parallels to the 2008 financial crisis, where rating agencies delayed acknowledging the risk of mortgage-backed securities, implying a similar underestimation of current U.S. debt risk.

The U.S. national debt has reached $36.8 trillion, with annual revenues of $4.9 trillion and expenses exceeding $6 trillion—over $1 trillion of which is interest. As debt rises, inflation and interest rate sensitivity increase, making insolvency more likely at lower inflation thresholds.

The article criticizes Trump’s tariff policies, suggesting they worsen the debt situation by disrupting global labor arbitrage. By imposing tariffs, especially on China (where labor is significantly cheaper), the U.S. risks importing inflation and reducing economic efficiency. The U.S. lacks the labor capacity to replace cheap foreign imports domestically, and if trade is rebalanced or illegal labor removed, inflation could spike.

Hedge funds and other investors are betting against U.S. debt, anticipating that these dynamics—rising tariffs, constrained labor, growing debt, and weakening dollar—will lead to higher inflation, rising interest payments, and possible economic instability. The author suggests that current monetary policy (like the Fed buying treasuries) is a desperate attempt to prevent collapse.

|

|

|

|

|

|

Orange Immortal [66517]

TigerPulse: 100%

60

Posts: 15495

Joined: 2018

|

Here it is stripped to the basics: FAFO***

May 21, 2025, 9:08 AM

|

|

|

|

|

|

|

|

Orange Elite [5224]

TigerPulse: 100%

38

|

Re: Here it is stripped to the basics: FAFO***

May 21, 2025, 9:28 AM

|

|

Yerp.

|

|

|

|

|

|

Top TigerNet [30251]

TigerPulse: 100%

55

Posts: 11655

Joined: 2011

|

|

|

|

|

|

Tiger Titan [48480]

TigerPulse: 100%

58

Posts: 19895

Joined: 2015

|

|

|

|

|

|

Clemson Icon [26478]

TigerPulse: 100%

54

Posts: 17831

Joined: 2024

|

|

|

|

|

|

Heisman Winner [87119]

TigerPulse: 100%

62

Posts: 26975

Joined: 2012

|

"TATS KNOTT HOW TEARIFFS WERK"

4

May 21, 2025, 9:18 AM

[ in reply to It's not real good. Credit default swaps on US debt are rising to levels ] |

|

Too much wording for increased inflation. As someone who works at at manufacturer, who has a China facility that supplies them with basically everything (as all US manufacturers do) we already all knew that China (and all other countries) are not paying these, they're putting them in the price of the product. Higher product costs literally = inflation.

Sorry for the incoming political rant but THANK YOU to all the dumb ############# who voted for the "businessman" who knows nothing about business. Party > policy

|

|

|

|

|

|

All-Time Great [90640]

TigerPulse: 100%

63

Posts: 62315

Joined: 2004

|

It's like all my Clemson econ professors were right, and the effects of the

2

May 21, 2025, 9:24 AM

|

|

Smoot-Hawley act were real.

How could Trump possibly have known what everyone else did 95 years ago?

|

|

|

|

|

|

Ring of Honor [22298]

TigerPulse: 100%

53

Posts: 17529

Joined: 1998

|

Whoa all the young MAGA bros got this! Do you even work out?***

May 21, 2025, 9:33 AM

|

|

|

|

|

|

|

|

Ultimate Clemson Legend [108654]

TigerPulse: 100%

64

Posts: 70535

Joined: 2002

|

Can't help but think the exchange rate/dollar to labor differences

May 21, 2025, 9:50 AM

[ in reply to It's like all my Clemson econ professors were right, and the effects of the ] |

|

may hold a much greater impact than guesstimates, based on how we measure imports, etc. I mean a dollar sent to Vietnam nets $42 in American labor. A dollar send to China nets $4 in American labor. A dollar sent to Mexico nets $8 in American labor.

So if you want to stop trade with China and bring those jobs back to the US, you are bringing back 4 times more jobs (labor) than the dollar amount would suggest. Bring $1 trillion in trade back from China, you're bringing back the equivalent of $4 trillion in labor. This exacerbates the labor discrepancy and enhances the inflationary potential.

|

|

|

|

|

|

Heisman Winner [87119]

TigerPulse: 100%

62

Posts: 26975

Joined: 2012

|

No one's bringing anything back to America. We're just shifting the chess

3

May 21, 2025, 9:58 AM

|

|

pieces to India or another SEA location. And/or shipping it to Canada to then import into America.

|

|

|

|

|

|

Ultimate Clemson Legend [108654]

TigerPulse: 100%

64

Posts: 70535

Joined: 2002

|

I know that, and you know that, but I don't think the MAGA crowd knows that.

May 21, 2025, 10:24 AM

|

|

I really wish there was some international system, or some way to measure, how many human beings are working for American companies and dollars, worldwide. Again, nearly impossible to quantify accurately, but whatever the number, it's MANY TIMES more than the jobs we could create inside the US, given our lack of extra human beings. I just took a sentence from this post and asked Google AI......

"how many human beings are working for American companies and dollars, worldwide"

Google AI was stumped. No way to tell. Then it started spouting off US numbers.

I know at one time JUST Apple had a quarter million Chinese workers at Foxxcon assembling JUST iPhones in China. Nike has 530,000 employees working in Vietnam. Intel has around 8k workers in Vietnam. AMD employs 12k employees in Asian countries. China has 12k Intel employees, India has 13K. Pepsico has 1.7 million employees in just India. WalMart has half a million people working overseas.

Bring just the jobs above back to the US, and we've given 100% of the unemployed jobs, and are probably running short, pretending we could transfer the infrastructure back to the US to support these jobs. Ok, what about the other jobs?

|

|

|

|

|

|

Oculus Spirit [43231]

TigerPulse: 100%

57

Posts: 21866

Joined: 2022

|

And nobody unemployed now is taking a factory job like those.***

May 21, 2025, 10:28 AM

|

|

|

|

|

|

|

|

Heisman Winner [81117]

TigerPulse: 100%

62

Posts: 64006

Joined: 2005

|

We don't really have factory jobs like those given our lack of slave labor

May 21, 2025, 1:48 PM

|

|

I've tried to explain this repeatedly, but alas it falls upon deaf ears. Anyone been in a modern textile facility? The only people on the production floor are janitors, then there's like 5 people in a control room. Even the places making cheap stuff like attic ladders are utilizing automation and robotics to minimize operator roles. I do find it interesting how the narrative has changed from "automation is going to kill jobs!" to "we don't have enough people to fill manufacturing jobs!", particularly given the advancement of automation in the past decade.

Hope your aquarium is doing well!

|

|

|

|

|

|

Tiger Titan [48839]

TigerPulse: 100%

58

Posts: 43571

Joined: 1998

|

Glad you now understand the tariffs were a terrible idea.***

May 21, 2025, 2:10 PM

|

|

|

|

|

|

|

|

Heisman Winner [81117]

TigerPulse: 100%

62

Posts: 64006

Joined: 2005

|

They've caused me some issues, but overall it is looking like they're going

May 21, 2025, 2:22 PM

|

|

to end up driving some, if not a fair amount of manufacturing back here. Implementation could have been a lot better, it's been difficult to navigate.

|

|

|

|

|

|

Tiger Titan [48839]

TigerPulse: 100%

58

Posts: 43571

Joined: 1998

|

It doesn't appear the jobs are going to get filled.

May 21, 2025, 2:43 PM

|

|

Not any time soon. There were 400,000 openings in February and they were struggling to fill them.

Americans don't want these jobs. Not current Americans, that is.

One of my friends who was all about the tariffs is now feeling the sting and he needs to find new work. But when it was suggested he go into some of the local manufacturing jobs, like Nucor? Nope. Completely balked at the idea.

|

|

|

|

|

|

Heisman Winner [81117]

TigerPulse: 100%

62

Posts: 64006

Joined: 2005

|

Which in turn drives automation. Hence the reason there's a million machine

May 21, 2025, 3:03 PM

|

|

builders popping up all around the Southeast now. There's also a stigma around manufacturing jobs for people ages 30-50 or so due to our education system instilling the idea that you'd be a failure for going that route instead of going to college, so that's something that needs to change. The cost of college now may help do that by itself.

|

|

|

|

|

|

All-Time Great [90640]

TigerPulse: 100%

63

Posts: 62315

Joined: 2004

|

Egg-zackly. And even if someone or a company were able to build manufacturing

May 21, 2025, 10:31 AM

[ in reply to No one's bringing anything back to America. We're just shifting the chess ] |

|

in the US (in <3 years when all this tariff nonsense gets whacked by the next guy in office), who is gonna do the jobs?

This is all crazy stupid rhetoric.

I took my dogs for a walk around my hood last night, and noticed the permanent Trump signs in a few yards silently disappearing.

|

|

|

|

|

|

Heisman Winner [81117]

TigerPulse: 100%

62

Posts: 64006

Joined: 2005

|

Hmm, not true. Most of the auto makers are ramping up domestic production

May 21, 2025, 1:33 PM

[ in reply to No one's bringing anything back to America. We're just shifting the chess ] |

|

Kubota is going to start fabricating frames in Georgia as opposed to importing from Japan, I know of a major Canadian PVC mfg that's spending a few milly to beef up their US operations...Isuzu setting up manufacturing in Piedmont, new Elringklinger facility in Easley, I personally work with 2 companies who are building new US facilities so they don't have to import from Germany anymore.

It's funny how the sentiment here is the exact opposite of everyone at Automate last week.

|

|

|

|

|

|

Heisman Winner [87119]

TigerPulse: 100%

62

Posts: 26975

Joined: 2012

|

Auto-makers have been in the US for a while

May 21, 2025, 2:32 PM

|

|

and were those new facilities green-lit because of the tariffs, or were they already in place because they're doing it for a different strategic issue. Anything that is small and costs less than (I'd guess) around $1000 or so, it not made here.

And automation is for those that have a more simplified process. We couldn't do it here at a simple faucet manufacturer. We have over 7K sellable items and over 40K subassembly parts. Way too many for automation because of setup times, etc. The only place it would work is in shipping/packing. Ever seen rough chrome polished out? Hand done job unless it's plated.

|

|

|

|

|

|

TigerNet Champion [118100]

TigerPulse: 100%

65

Posts: 69251

Joined: 2002

|

Hand jobs, huh?

2

May 21, 2025, 2:56 PM

|

|

|

|

|

|

|

|

Heisman Winner [87119]

TigerPulse: 100%

62

Posts: 26975

Joined: 2012

|

Those doods have the tightest grip of anyone you'll ever meat

May 21, 2025, 3:10 PM

|

|

if they let the thing go, molding goes straight through you.

|

|

|

|

|

|

Heisman Winner [81117]

TigerPulse: 100%

62

Posts: 64006

Joined: 2005

|

Not all of them, like Isuzu. Most of this stuff has recently been green lit

May 21, 2025, 2:58 PM

[ in reply to Auto-makers have been in the US for a while ] |

|

Now they won't come out and explicitly say why, but I would say the writing is on the wall.

Not true at all...lots of small, cheap parts are made in the US. I sell the fugg out of a certain electrical connector made in Michigan and export them to India, China, Germany, etc. Probably not for too much longer since they'll just reverse engineer it, but so far so good. I see a lot of places starting to either bring stuff in house, or finding a more local supplier. Not to say all of that is due to tariffs, but that's the shift that seems to be happening.

You could probably automate it, it's just a matter of how much you want to spend. Vision systems have come a looooong way, you could have a polishing wheel on a robot to polish out that chrome...Put it in a fixture, use vision inspection to make sure the entire surface gets polished...but it's probably more cost effective to have a person do it, I'm guessing. Assuming you are running a fair amount of CNC's, all of those could be robotically tended, that's starting to become bigger thing. Flex feeding has gotten really good, use vision to determine what part is coming down the line, and kick off the process from there.

No way you eliminate all operators, but some of the new automation stuff coming out is impressive.

|

|

|

|

|

|

Clemson Sports Icon [52833]

TigerPulse: 100%

59

Posts: 33434

Joined: 2015

|

TIL Lakebum has had my bathroom faucets in his sun kissed hands***

May 21, 2025, 3:00 PM

|

|

|

|

|

|

|

|

Heisman Winner [87119]

TigerPulse: 100%

62

Posts: 26975

Joined: 2012

|

Do a Buy America Act analysis on a company's portfolio of sellable items

May 21, 2025, 3:21 PM

[ in reply to Not all of them, like Isuzu. Most of this stuff has recently been green lit ] |

|

your mind will be blown. It has to have 75% of direct costs associated with it to be considered a US product and most of these are getting this approval because of.................overhead. They're shipping it in, applying procurement and admin to it and then passing it off as American.

You mention 1 connector and you're probably right. We have several of those too. We had a very popular line of hoses that we got from a US company, until we moved it last year. But that's still a handful out of the 8K products we have. It's easy to find one, but still the overwhelming majority of items, and more importantly subassemblies/unfinished goods are coming from out of the US.

We do it, our competitors do it, our pier review group of other privately owned manufatures do it. That's the way it is. We can't make stuff paying people $16K a year.

|

|

|

|

|

|

Heisman Winner [81117]

TigerPulse: 100%

62

Posts: 64006

Joined: 2005

|

That's definitely true for a lot of things and isn't going to change

May 21, 2025, 3:52 PM

|

|

There's a lot of fuckery that goes on though...for instance a new line is designed, quoted, and a PO issued to what amounts to a store front in let's say Pelzer. Yay, we're buying this line locally! However, the builder receiving the PO then purchases those components out of Mexico where the actual line is being built, then they fly everyone up to install it in wherever USA. Then the guys on the US side get to eat the shid sandwich of not only splitting commission(if they get any out of it), but having to support the line as well.

We can do things to disincentivize that sort of thing and help boost local economies. We're the only country in the world that doesn't.

|

|

|

|

|

|

Ultimate Tiger [35066]

TigerPulse: 100%

56

Posts: 39199

Joined: 2003

|

|

|

|

|

|

Tiger Titan [48839]

TigerPulse: 100%

58

Posts: 43571

Joined: 1998

|

It'll take years, maybe decades to bring anything back

May 21, 2025, 2:13 PM

|

|

You would have to have a complete upheaval of societal goals, manufacturing goals, and educational goals. What we used to have gradually faded away; it isn't coming back overnight.

All of this will be wiped clean by the next administration that actually employs sane adults who understand economics, and this economic wreck will have been for nothing.

|

|

|

|

|

|

Ultimate Tiger [35066]

TigerPulse: 100%

56

Posts: 39199

Joined: 2003

|

yep...labor and infrastructure aren't going to allow a very rapid change...

1

May 21, 2025, 2:16 PM

|

|

I even think the overarching idea is in the right area, but it should be targeted. We don't need/want most textile jobs back but we could sure focus on real value-added manufacturing and national security sectors.

|

|

|

|

|

|

Heisman Winner [81117]

TigerPulse: 100%

62

Posts: 64006

Joined: 2005

|

I think the Upstate is a good example of how quickly the work force can change

May 21, 2025, 2:38 PM

|

|

to meet the needs of the manufacturing sector. We don't need mass amounts of low skilled labor to meet those needs anymore, either.

|

|

|

|

|

|

Heisman Winner [87119]

TigerPulse: 100%

62

Posts: 26975

Joined: 2012

|

You're right, we don't need low skilled labor. But if we're making it from

May 21, 2025, 2:41 PM

|

|

beginning raw materials to finished product here, get ready for price increases of 500% or businesses just simply canceling lines.

|

|

|

|

|

|

Ultimate Tiger [35066]

TigerPulse: 100%

56

Posts: 39199

Joined: 2003

|

What are you meaning specifically?....

May 21, 2025, 2:49 PM

[ in reply to I think the Upstate is a good example of how quickly the work force can change ] |

|

I sat in on something recently that covered a wider area than just SC upstate, but there was discussion on the number of underemployed manufacturing workers that have been able to fill some gaps over the past 2 yrs or so, but that a lot of the new manufacturing jobs are being filled by folks that have been recently laid off from other manufacturing jobs. So it feels like it's easier to fill new jobs versus 2-3 yrs ago (and it is certainly that way for us), but that that is about to stop being the case soon.

And I agree about the low-skilled part, but we will if we really want to move maufacturing here for most all of the imports getting hit with tariffs.

What I do see is a shift at the high school level in the schools heavily promoting a non-college career tract and putting a lot of resource in developing that. Anderson Institute of Technology is a great example of that. They have a first-class operation there. Same goes for Hart County College and Career Academy.

We're taking a much more active role in those kind of places and starting work study internships, guest lecturing, etc...I want to sell the financial model to kids of starting in a good paying manufacturing career right out of high school. They can be making $22/hr with us after a year, plus quarterly bonus right now, with full benefits, as well as tuition reimbursement if they want to pursue a degree applicable to our business. Compare that to a kid heading right into college and accumulating student loan debt and the numbers are powerful.

|

|

|

|

|

|

Clemson Sports Icon [52833]

TigerPulse: 100%

59

Posts: 33434

Joined: 2015

|

We are a direct FTE line to Nucor

May 21, 2025, 2:54 PM

|

|

|

|

|

|

|

|

Heisman Winner [81117]

TigerPulse: 100%

62

Posts: 64006

Joined: 2005

|

Basically what you just said

May 21, 2025, 3:08 PM

[ in reply to What are you meaning specifically?.... ] |

|

"What I do see is a shift at the high school level in the schools heavily promoting a non-college career tract and putting a lot of resource in developing that. Anderson Institute of Technology is a great example of that. They have a first-class operation there. Same goes for Hart County College and Career Academy.

We're taking a much more active role in those kind of places and starting work study internships, guest lecturing, etc...I want to sell the financial model to kids of starting in a good paying manufacturing career right out of high school. They can be making $22/hr with us after a year, plus quarterly bonus right now, with full benefits, as well as tuition reimbursement if they want to pursue a degree applicable to our business. Compare that to a kid heading right into college and accumulating student loan debt and the numbers are powerful."

That's a pretty big societal shift that happened relatively quickly in this area to accommodate the manufacturing sector. I think you see the same cycle every 4-5 years, kind of follows automotive programs. Everything is wide open at the beginning, as the programs draw down so do volumes, people get laid off, then the retooling begins again, rinse and repeat. It's a big reason most of the automation companies are trying to diversify out of being so heavily automotive centric.

|

|

|

|

|

|

Tiger Titan [48839]

TigerPulse: 100%

58

Posts: 43571

Joined: 1998

|

Re: What are you meaning specifically?....

May 21, 2025, 3:21 PM

[ in reply to What are you meaning specifically?.... ] |

|

Schools shifted away from that gradually and repurposed facilities that could accommodate such learning. They also don't attract teachers who can teach those skills.

Could they bring it back? Sure, but a LOT has to change and a ton of money is going to have to follow. Starting in the 90s, the push for everyone to go to college became too strong. I'm not advocating it, but it is what it is.

Most facilities aren't equipped for it. New schools built after 2000 in the post-Columbine era were built to be semi-fortresses and they left out classroom facilities that could teach these skills. Only those with money and vision to do it in SC kept them, but even then they've usually been repurposed.

Can all that come back in four years? I don't think it can, and by then, America will shift back to what it was before this administration. And school districts in SC are not scrambling at the moment to bring it back.

I think that's where a lot of folks are missing this: It's going to get undone. All of it. It was a fruitless effort executed poorly.

|

|

|

|

|

|

Ultimate Tiger [35066]

TigerPulse: 100%

56

Posts: 39199

Joined: 2003

|

hmm...I'm not as negative long-term...

May 21, 2025, 3:35 PM

|

|

the shift away from the college push has been happening long before Trump's ill-conceived tariff/isolationist push. Of course, it's not all manufacturing based either.

The on-shoring push was happening a bit pre-covid, but covid exposed the risks in the supply chain for most companies and on-shoring has been on steroids since then. I've seen a lot happening in SC and GA over the last 10 or so years in terms of public school systems putting a serious emphasis on non-college career paths.

|

|

|

|

|

|

Heisman Winner [81117]

TigerPulse: 100%

62

Posts: 64006

Joined: 2005

|

We don't need schools to do anything other than not push the idea everyone

1

May 21, 2025, 3:36 PM

[ in reply to Re: What are you meaning specifically?.... ] |

|

has to go to college to be successful. They don't need the facilities or teachers necessarily, they just need to partner with local manufactures like flow describes to offer those programs to kids....Or even just introduce them to the financial realities of going into that world.

Even engineers coming out of Clemson are getting tons of on the job training, my sister did an entire year of hands on training with the company she's with after graduating from Clemson in mech engineering. That's in addition to the 2 semesters of internships she did at a local manufacturer during college. School is not where you learn this kind of stuff, it's knowledge that can only be acquired by doing. All of this was starting to happen before Trump and will continue regardless of who the next President is.

|

|

|

|

|

|

Clemson Sports Icon [52833]

TigerPulse: 100%

59

Posts: 33434

Joined: 2015

|

This trend ended in the late 2010's

May 21, 2025, 3:45 PM

|

|

Schools that I am aware of are sending more students to trade/industry/tech in way larger numbers than 4-year colleges.

Many students in these schools graduate career-ready. Career-ready is a large part of a school's state report card. Students in health science graduate with their CNA certification.

Students in welding graduate and can immediately sit for their AWS (you can't take AWS until you graduate)

There is no longer that push that it's college or McDonald's like it was when I was in high school, at any school that I know of, and I know what's going on in a lot of schools in my area asa head ball inflator.

|

|

|

|

|

|

Clemson Sports Icon [52833]

TigerPulse: 100%

59

Posts: 33434

Joined: 2015

|

On the other side of that coin, students are taking advantage of dual credit

May 21, 2025, 3:47 PM

|

|

courses. There are a bunch of kids each year who graduate from high school and enter college as a sophomore.

And many of these districts pay for the dual credit courses.

So instead of 20k a year for 4 years, they're paying 20k a year for 2 years. They already have their gen ed credits.

|

|

|

|

|

|

Heisman Winner [81117]

TigerPulse: 100%

62

Posts: 64006

Joined: 2005

|

That's good to hear on both fronts***

May 21, 2025, 3:54 PM

|

|

|

|

|

|

|

|

Heisman Winner [87119]

TigerPulse: 100%

62

Posts: 26975

Joined: 2012

|

It costs almost as much sometimes for an American to unpack a product and put

May 21, 2025, 2:39 PM

[ in reply to I don't think that's true...what I would say is that there's not as much... ] |

|

it in inventory as it does for us to buy it from our China facility that's already made the whole thing, shipped it, recognized a profit for Chinese GAAP, paid VAT taxes, and applied purchasing overhead. FTE hourly rate at my work last I checked was like $45-60 or so depending on the department and that was probably like 5 years ago when I actually looked at that stuff. Even with a 690% tariff we still can't compete with what it would cost coming out of China.

People are moving away from China, but they're still going to be buying things over seas. India and Vietnam mostly.

|

|

|

|

|

|

Heisman Winner [81117]

TigerPulse: 100%

62

Posts: 64006

Joined: 2005

|

Oh no doubt, no argument there...

May 21, 2025, 3:16 PM

|

|

It all depends on what the product is, we aren't going to become the worlds #1 supplier of silicon peanus rings and stuff like that, nor should we strive to. But I think it helps everybody if someone like Borg Warner sources their bearings from Timken down the street vs. China, even if it costs a little more. Overseas quality control (aside from Germany) usually isn't the best, which is OK for silicone peanus rings...but more of a problem when it comes to the bearings in your transmission.

|

|

|

|

|

|

All-Time Great [90640]

TigerPulse: 100%

63

Posts: 62315

Joined: 2004

|

Is Timken still open in the upstate? I thought they moved all that to Mexico

May 21, 2025, 3:55 PM

|

|

or Thailand or something.

I know buying a set of Timken bearings made anywhere for a boat trailer hub is, as they say, "cost prohibitive".

|

|

|

|

|

|

Heisman Winner [81117]

TigerPulse: 100%

62

Posts: 64006

Joined: 2005

|

There's a couple, they've got plants in China and probably Mexico too

May 21, 2025, 4:04 PM

|

|

A think a lot of the Ford ones come from China, so my analogy above probably isn't the greatest.

|

|

|

|

|

|

All-Time Great [90640]

TigerPulse: 100%

63

Posts: 62315

Joined: 2004

|

I'd rather have Timken bearings, or SKF's or even NSK's

May 21, 2025, 4:12 PM

|

|

But at 3-4x the cost of the Chinese stuff, its just not worth it.

The seals seem to be the most important part of that whole assembly anyway.

|

|

|

|

|

|

Ultimate Clemson Legend [108654]

TigerPulse: 100%

64

Posts: 70535

Joined: 2002

|

|

|

|

|

|

Ultimate Clemson Legend [108654]

TigerPulse: 100%

64

Posts: 70535

Joined: 2002

|

My point is there's more "out there" than the admin realizes

May 21, 2025, 4:50 PM

[ in reply to I don't think that's true...what I would say is that there's not as much... ] |

|

Unless we're going to do some serious robot stuff, and automation, we generally lack the labor supply. Invest all the dollars you like. Invest in whatever, training, jobs, automation, plants, infrastructure, all of that just adds to the cost.....inflation.

You hear it all the time, 5 MILLION manufacturing jobs lost since 2000. FINE. We have 4% unemployment, and an 85% prime age LPR. We have millions of boomers also in the process of retiring, lowering the overall LPR, putting added pressure on prime age LPR.

Add to that the deletion of 10 million illegals, and you have a recipe for inflation. It could be a LOT more than we think.

|

|

|

|

|

|

Heisman Winner [81117]

TigerPulse: 100%

62

Posts: 64006

Joined: 2005

|

We are doing some serious stuff with robots and automation

1

May 22, 2025, 10:31 AM

|

|

There are still some holdouts that don't want to spend the money, but by and large most processes have some degree of it. Whether it's here or over seas, and that robot costs the same in China as it does here....So it might as well be here. Your mindset seems to be keep costs low at any cost, and that's a losing recipe in the long run every time.

Deleting 10 million illegals and the pressure they put on healthcare, education, and housing prices probably ends up being a net positive for the US citizen.

|

|

|

|

|

|

All-Time Great [90640]

TigerPulse: 100%

63

Posts: 62315

Joined: 2004

|

Look man, you are harshing my mello. I have some RSU's coming due Friday

1

May 21, 2025, 9:05 AM

|

|

and that stock still needs to raise about $30/share before I can even exercise the option.

|

|

|

|

|

|

Top TigerNet [30251]

TigerPulse: 100%

55

Posts: 11655

Joined: 2011

|

hedge

1

May 21, 2025, 9:26 AM

|

|

|

|

|

|

|

|

All-Time Great [90640]

TigerPulse: 100%

63

Posts: 62315

Joined: 2004

|

Its an RSU. I have one choice.

May 21, 2025, 9:28 AM

|

|

Either the stock gets back to where it was when they gave it to me and I can sell it (for hopefully more).

Or it doesn't, and I can't do anything.

Do you even RSU bruh?

|

|

|

|

|

|

Top TigerNet [30251]

TigerPulse: 100%

55

Posts: 11655

Joined: 2011

|

lol

May 21, 2025, 10:54 AM

|

|

I was referring more broadly...

my wife does.

i just got straight equity, so no.

|

|

|

|

|

|

All-Time Great [90640]

TigerPulse: 100%

63

Posts: 62315

Joined: 2004

|

I hadn;t noticed the BTC run up.

May 21, 2025, 11:14 AM

|

|

It's almost back to where I bought my last $3K worth lol.

This RSU was set to make some srs cash..until our president got whacked, then our CEO quit. It's dropped like 48% this year.

|

|

|

|

|

|

Top TigerNet [30251]

TigerPulse: 100%

55

Posts: 11655

Joined: 2011

|

it's at ATH

May 21, 2025, 2:56 PM

|

|

stop lyin bro

|

|

|

|

|

|

Heisman Winner [81117]

TigerPulse: 100%

62

Posts: 64006

Joined: 2005

|

Stock market will be running on Solana in 5-10 years. Heard it here first***

May 21, 2025, 3:18 PM

|

|

|

|

|

|

|

|

Clemson Icon [26478]

TigerPulse: 100%

54

Posts: 17831

Joined: 2024

|

Re: Stock market will be running on Solana in 5-10 years. Heard it here first***

May 21, 2025, 4:15 PM

|

|

Do you really like Solana?

|

|

|

|

|

|

All-Time Great [90640]

TigerPulse: 100%

63

Posts: 62315

Joined: 2004

|

Just checked..

May 21, 2025, 3:52 PM

[ in reply to it's at ATH ] |

|

I bought $3045 BTC on 12/5/24 when 1 BTC was worth $101,884.81 USD.

I've barely looked at it since then, and purposely ignored it after Feb when it go down to ~$80K.

For the last 3 weeks, I haven't looked at any news or clocks, and barely my cell phone so I had no idea what its up to since 4/23.

Lutz..it's up 5K in the last week:

And $21K in the last month

I have no idea how I missed it!

too funny

|

|

|

|

|

|

All-Time Great [90640]

TigerPulse: 100%

63

Posts: 62315

Joined: 2004

|

Re: Its an RSU. I have one choice.

May 21, 2025, 4:20 PM

[ in reply to Its an RSU. I have one choice. ] |

|

Well Shyatt. It ain't making RSU sell price by Friday. Down another 6% today.

I wish I could deduct this effective decrease in my annual pay from my taxes.

Maybe I won't have to pay those IRS bloodsuckers so much next year.

|

|

|

|

|

|

Ultimate Clemson Legend [108654]

TigerPulse: 100%

64

Posts: 70535

Joined: 2002

|

Crypto and gold are the best hedges, along with Ligustrum and Holly bushes.

May 21, 2025, 11:21 AM

[ in reply to hedge ] |

|

Problem is, if the feces ever really hits the fan, the hedges that work are the ones the governemnt will come after. If BTC sees a rise as people hedge against the dollar, the governemnt can regulate it to make it nearly impossible to invest in it. If gold spikes too much, they coan confiscate Americans' gold and set a fixed price for it.

If you really want to hedge, maybe with crypto or gold, I'd make sure to do it overseas. This way if you have 100kg of gold bars in a Swiss vault, and the US confiscates domestic gold from citizens, and makes owning it illegal (as happened before), you can always sell your Swiss gold in Switzerland for Euros and use the euros to buy shares of some stable stock in Europe, then sell that and just pay capital gains.

|

|

|

|

|

|

TigerNet Elite [71126]

TigerPulse: 100%

61

Posts: 25307

Joined: 2017

|

Like.in your opinionumCOVID

May 21, 2025, 3:31 PM

|

|

its origins and its best treatment? Cause you want no conversation but your own.

|

|

|

|

|

|

TigerNet Champion [118100]

TigerPulse: 100%

65

Posts: 69251

Joined: 2002

|

Re: Like.in your opinionumCOVID

May 21, 2025, 3:33 PM

|

|

So give us your opinionum

or don't

I can't believe people are still debating COVID

|

|

|

|

|

|

All-Time Great [90640]

TigerPulse: 100%

63

Posts: 62315

Joined: 2004

|

What's left to debate?

1

May 21, 2025, 3:58 PM

|

|

It turned into a power grab by local, state and federal gov't, whatever anyone thinks about the actual sickness, it's source or treatment.

Henry McMaster can deny that hoping no one remembers his antics in it...but Pepperidge Farms remembers.

|

|

|

|

|

|

Ultimate Clemson Legend [108654]

TigerPulse: 100%

64

Posts: 70535

Joined: 2002

|

|

|

|

|

|

All-Time Great [90640]

TigerPulse: 100%

63

Posts: 62315

Joined: 2004

|

|

|

|

|

|

Ultimate Clemson Legend [108654]

TigerPulse: 100%

64

Posts: 70535

Joined: 2002

|

They did this all over the world. Some places MUCH MUCH worse.

May 22, 2025, 1:23 PM

|

|

Technically, DHEC has the legal authority to enter your home, and extract your person, take you to a quarantine facility until well or dead. It's in the SC codes. I've posted them before.

SC's response was about average, some states were worse, some better, some did nothing. But worldwide, mask mandates, lockdowns, quarantines, etc. were FAR more common than not.

|

|

|

|

|

|

Heisman Winner [81117]

TigerPulse: 100%

62

Posts: 64006

Joined: 2005

|

DHEC can get shot in the face too, which is probably a big reason we didn't

2

May 22, 2025, 1:31 PM

|

|

get it much, much worse like some of those other places. They certainly wanted to take it there, and I have no doubt would have without push back. I knew it wasn't about safety when they were harassing people on their own boats in the middle of the lake, trying to bully them off the water.

|

|

|

|

|

|

All-Time Great [90640]

TigerPulse: 100%

63

Posts: 62315

Joined: 2004

|

Telling me it was worse in other parts of the world is like telling your kid

3

May 22, 2025, 2:06 PM

[ in reply to They did this all over the world. Some places MUCH MUCH worse. ] |

|

there are people starving in Africa so they need to eat their vegetables.

Frankly, I don't care what was going on in Australia; that doesn't make it any more right or excusable that McMaster was shutting down boat ramps and Sullivan's island cops were blocking people from entering the island.

It was ridiculous amounts of governmental overreach.

|

|

|

|

|

|

Valley Legend [12182]

TigerPulse: 100%

47

|

Re: But,

May 22, 2025, 3:34 PM

|

|

But we was askert!!

You gonna believe me or or your lying eyes!?

|

|

|

|

|

|

All-Time Great [90640]

TigerPulse: 100%

63

Posts: 62315

Joined: 2004

|

I'll always take the opinions of a back woods hick lawyer turned governor

1

May 22, 2025, 3:37 PM

|

|

that sounds like Foghorn Leghorn's long lost brother over any amount of common sense.

|

|

|

|

|

|

Clemson Icon [26478]

TigerPulse: 100%

54

Posts: 17831

Joined: 2024

|

Re: Like.in your opinionumCOVID

May 21, 2025, 4:17 PM

[ in reply to Like.in your opinionumCOVID ] |

|

Why you were só consumed with the origins of COVID is beyond me. Why did it matter to you where it came from? We knew China. What for you is the difference if it came from a lab accidentally or somewhere else?

|

|

|

|

|

|

Replies: 79

| visibility 4891

|

|

|