|

Replies: 83

| visibility 3061

|

TigerNet Elite [76716]

TigerPulse: 100%

61

Posts: 17765

Joined: 2018

|

Boomer wealth article in the WaPo today. Relates to our discussion last week or

3

Nov 18, 2025, 12:27 PM

|

|

so. I can't c&P the whole thing because there is a shittton of graphs etc but it is pretty interesting.

If any of you want a temp gift pass I think I can send some, just tmail me your email address.

How baby boomers got so rich and why their kids are unlikely to catch up

The wealthiest generation holds more than $85 trillion in assets thanks to economic conditions Gen X, millennials and others would be hard-pressed to replicate.

Baby boomers hold more than $85 trillion in assets, making them the richest generation by far. New research explores the extraordinary rise in their good fortunes — one that experts say successive generations will be hard-pressed to replicate.

The reasons come down to timing and time: Americans 75 and older bought homes and invested in stocks well before such assets exploded in value, according to Edward Wolff, an economics professor at New York University. In a working paper for the National Bureau of Economic Research, he examined the four decades between 1983 and 2022 when those older boomers saw their wealth climb and their younger peers recorded relative declines.

https://www.washingtonpost.com/business/2025/11/18/baby-boomer-wealth/

Message was edited by: KenM_Tigerfann®

|

|

|

|

|

TigerNet Champion [113050]

TigerPulse: 100%

65

Posts: 73083

Joined: 2002

|

|

|

|

|

|

Orange Immortal [62354]

TigerPulse: 100%

60

Posts: 25258

Joined: 1998

|

No graphs

2

Nov 18, 2025, 12:37 PM

|

|

How baby boomers got so rich and why their kids are unlikely to catch up

The wealthiest generation holds more than $85 trillion in assets thanks to economic conditions Gen X, millennials and others would be hard-pressed to replicate.

November 18, 2025 at 5:00 a.m. ESTToday at 5:00 a.m. EST

7 min

By Shannon Najmabadi and Federica Cocco

Baby boomers hold more than $85 trillion in assets, making them the richest generation by far. New research explores the extraordinary rise in their good fortunes — one that experts say successive generations will be hard-pressed to replicate.

The reasons come down to timing and time: Americans 75 and older bought homes and invested in stocks well before such assets exploded in value, according to Edward Wolff, an economics professor at New York University. In a working paper for the National Bureau of Economic Research, he examined the four decades between 1983 and 2022 when those older boomers saw their wealth climb and their younger peers recorded relative declines.

“It’s astonishing how their relative wealth has taken off in the last 30-plus years,” Wolff said. “They started out as among the poorest groups in terms of wealth back in 1983.”

The wealth of baby boomers — especially those in retirement — is a reflection of the uniquely favorable economic conditions that occurred during their working lives, Wolff and other economists said. So much so that it would be difficult for younger generations to emulate, especially as they are more likely to be weighed down by debt or child care costs.

Housing costs also factor into the widening divide between baby boomers (born from 1946 to 1964) and everyone else, experts say. Generation X (1965 to 1980), millennials (1981 to 1996) and their successors increasingly dedicate a bigger portion of their budgets to mortgage or rent.

People might assume boomers’ wealth reflects superior financial decision-making, if they don’t consider the historical context that allowed boomers to build their wealth over decades, said Olivia Mitchell, professor of business economics and public policy at the University of Pennsylvania’s Wharton School.

What happened?

Good economic conditions

Baby boomers “entered the labor force during decades of strong economic growth, rising productivity and relatively high real wages,” Mitchell said. They were in their prime earning and saving years during long bull markets, namely in the 1980s and ’90s, she said, as well as the economic recovery that followed the Great Recession. They faced lower tuition and health care costs, and benefited from favorable tax policies, including lower capital gains tax rates, she said.

By contrast, younger generations endured the Great Recession — which ran from late 2007 to mid-2009 — early in their careers and more volatile capital markets afterward, she said.

And “particularly for middle-income workers, real wage gains since the 2000s have been modest, compared to the robust wage growth that boomers benefited from mid-career,” Mitchell said.

By age 30, the average millennial had about twice as much debt as their baby boomer counterpart, said Jeremy Ney, a professor at Columbia University’s business school.

Post-World War II, “you had this tremendous boom that many got to ride for a very long period of time,” Ney said. “And when you compare that to the bursting of the dot-com bubble, when you compare that to the 2008 housing crisis, when you compare that to the declines of covid, it made it much more difficult for people to invest, accumulate wealth.”

The rise of 401(k)s and stock holdings

Some older boomers benefited from having access to defined-benefit pension plans, many of which were phased out in the private sector in the 1980s as tax-advantaged 401(k)s became commonplace. The rise of such employer-sponsored retirement plans also drove up baby boomers’ stock holdings.

Today, about half of baby boomers’ wealth is tied up in cash, bonds, stocks or mutual funds held directly or through retirement accounts, or other financial holdings, Mitchell said, citing 2023 survey data from the Federal Reserve. Though the generation makes up about one-fifth of the population, they hold more than half of corporate equities and mutual fund shares.

Baby boomers have accumulated $85.4 trillion in wealth through the second quarter, according to Federal Reserve data. That’s nearly twice as much as Gen X and four times more than millennials.

Younger generations are more likely to have debt, leaving less to save or invest, Ney said, citing student loans and child care costs that nearly doubled between the mid-1980s and 2011, according to the U.S. Census Bureau.

“In 1940 there was a 90 percent chance that you were going to earn more than your parents. To somebody born today, it is just a coin flip,” Ney said.

Millennials and Generation Z (those born between 1997 and 2012) also tend to be more risk-averse when it comes to investing in the stock market, compared with members of the Silent generation (1928 to 1945), boomers and Gen X that lived through better economies, Ney said.

“Gen Z does not buy the dip,” he said. “They are too nervous to engage in the stock market” when prices are low.

The big story: Housing

Perhaps the biggest share of baby boomers’ wealth comes from their home.

Many were better positioned to buy or refinance their homes during stretches with particularly low interest rates, including after the Great Recession and during the covid-19 pandemic, said Annamaria Lusardi, academic director of Stanford University’s Initiative for Financial Decision-Making.

The nation’s median home price was $410,800 in the second quarter, compared with the $327,100 recorded just before the pandemic started in 2020, Federal Reserve data show. Medians are significantly higher in the Northeast ($796,700) and the West ($531,100).

By comparison, the median home price in the first quarter of 1976 — when the oldest boomers were 30 — was $42,800, Fed data show. That would be $242,400 adjusted for inflation.

While higher home valuations have bolstered the net worth of existing owners, Lusardi said, they’re outpacing the earnings of younger adults. Nor are they helped by current mortgage rates, which have hovered above 6 percent on a 30-year loan since September 2022.

About one-third of baby boomers’ wealth today is equity in their primary residence, Mitchell said, citing the 2023 survey. Boomers overall bought homes at younger ages than later cohorts and when prices were significantly lower, allowing them to benefit from decades of home appreciation.

The typical age of first-time home buyers recently hit an all-time high of 40 years, up from late-20s in the 1980s, according to a 2025 National Association of Realtors survey.

“Even when you look at that same age, you tend to see much lower rates of homeownership, and therefore much lower rates of wealth accumulation,” Ney said.

Michael Walden, a professor emeritus of economics at North Carolina State University, said some of the divergence might be due to preference — such as younger adults preferring to rent rather than assume responsibility for home repairs, or to wait for a perfect home rather than settling for a starter home they might hold onto for a few years until they had enough equity to move up.

“Their attitude about buying housing is very different than what my parents ingrained in me which was” to ‘just get your foot in the door’ with a starter house, Walden said. “It’s probably not going to be adequate, but a few years later, you’ll be able to sell it for more and just work your way up.”

|

|

|

|

|

|

TigerNet Icon [153036]

TigerPulse: 100%

68

Posts: 96187

Joined: 1998

|

I don't have time to read that crap.

5

5

Nov 18, 2025, 12:37 PM

|

|

I've got to go out and make sure my maintenance servants properly sweep my dog's private tennis court before her 2:00 lesson.

|

|

|

|

|

|

National Champion [7517]

TigerPulse: 100%

42

|

their's was a golden era for Americans

3

Nov 18, 2025, 12:45 PM

|

|

I envy what they had. Grandfather was a navy vet and then worked his way up to be a plant manager, made the equivalent of about $130k now at the top of his career. Had 4 kids, grandma was a substitute teacher. owned a big house, put all four kid through college, then retired to the Country Club of North Carolina in their custom built home for 35 years. Golf everyday, restaurants every night. Had a pension. Was a terrible investor (a true wallstreetbets regard before such a thing was common nomenclature). Still died at 98 with plenty of money. That life doesnt feel attainable on that income anymore.

I think its mostly attributable to being earlier in capitalism with less sophisticated systems to surpress wages and suck money from people, coupled with several unbelievable bull runs in the stock market.

|

|

|

|

|

|

TigerNet Elite [76716]

TigerPulse: 100%

61

Posts: 17765

Joined: 2018

|

What's a pension?***

4

Nov 18, 2025, 12:47 PM

|

|

|

|

|

|

|

|

TigerNet Elite [76716]

TigerPulse: 100%

61

Posts: 17765

Joined: 2018

|

Also he got 100% of social security. We're finna get a can of spam 2x a month.***

3

Nov 18, 2025, 12:48 PM

|

|

|

|

|

|

|

|

All-TigerNet [5695]

TigerPulse: 100%

39

|

|

|

|

|

|

TigerNet HOFer [124201]

TigerPulse: 100%

66

Posts: 71296

Joined: 2002

|

What is a country club?******

2

Nov 18, 2025, 1:43 PM

|

|

|

|

|

|

|

|

National Champion [7517]

TigerPulse: 100%

42

|

|

|

|

|

|

Tiger Titan [50831]

TigerPulse: 100%

58

Posts: 20640

Joined: 2015

|

Whatever jerk.

4

Nov 18, 2025, 12:47 PM

|

|

NOT MY FAULT YOU WON'T SAVE 20% AND DRIVE AN OLD PINTO AND CHOOSE TO WASTE MONEY ON FANCY FLAT SCREENS AND SOUND BARS LEMME GUESS YOU HAVE A CELL PHONE TOO SMMFH GOOBERS.

|

|

|

|

|

|

Orange Immortal [61648]

TigerPulse: 100%

60

Posts: 28769

Joined: 1999

|

Shut up and eat ur Rush's chili cheeseburger.*******

4

Nov 18, 2025, 1:27 PM

|

|

|

|

|

|

|

|

Paw Warrior [4965]

TigerPulse: 100%

37

|

We used to drink water outta the garden hose

1

Nov 18, 2025, 4:36 PM

[ in reply to Whatever jerk. ] |

|

Now the youngsters drink $2/bottle from Deer Park. Don't complain to me about net worth when you're spending $2 on water

|

|

|

|

|

|

TigerNet Grandmaster [198407]

TigerPulse: 100%

71

Posts: 39994

Joined: 2007

|

We had a hose pipe

1

Nov 18, 2025, 4:42 PM

|

|

lol. My wife laughed at me the first time I told her to get the hose pipe. She had no idea what I was talking about.

|

|

|

|

|

|

All-Time Great [94300]

TigerPulse: 100%

63

Posts: 64507

Joined: 2004

|

She prob had no idea what a "hose pipe" was.

Nov 18, 2025, 5:17 PM

|

|

I had never heard the term until I dated a girl from the upstate.

|

|

|

|

|

|

TigerNet HOFer [124201]

TigerPulse: 100%

66

Posts: 71296

Joined: 2002

|

Fantastic to know. My wife just spent some of our limited disposable income

6

6

Nov 18, 2025, 12:58 PM

|

|

on a bedside mat for her boomer grandfather to keep from slipping and falling every time he gets out of the floor.

So while some of us will never reach the wealth of their boomer family members, others have boomer family members actively costing them money.

Yeah, this sounds like me being an asssshole and I wrote it that way, but it is really us helping from a distance because we cannot be there daily. I'm not THAT big of an asssshole.

I also spent 3-4 years helping out both my boomer parents while they were still on this mortal coil, picking them off the floor and driving them to innumerable doctor appointments.

|

|

|

|

|

|

Orange Beast [6306]

TigerPulse: 100%

40

|

My parents aren't technically boomers but I just had to school them

5

5

Nov 18, 2025, 1:05 PM

|

|

Dad was complaining about the price of eating Thanksgiving dinner at their golf club... $50/person ($500 for the whole family of 10 before tip).

I've hosted Turkey for the past 10 years or so and I easily spend that much in groceries, and I also have to take off an entire day of work the day before to prep which easily makes it a $1000 meal.

He did offer to give me money after I pointed that out, lol.

|

|

|

|

|

|

TigerNet Champion [113050]

TigerPulse: 100%

65

Posts: 73083

Joined: 2002

|

Reminds me of when my parents sold my their house, where I was raised.

1

Nov 18, 2025, 1:22 PM

|

|

They paid $140K for it in like 1981. They sold in (paid off) in 2017, for $335K. Mom and dad were ecstatic, as they "made" almost $200K on the "investment". I mean they honestly thought they had a windfall.

I then reminded them they paid probably $300K for the house over the years (decades), even with a refi, in interest plus principal in mortgage payments. FURTHERMORE, simply adjust that $140K dollars spent in 1981 buying the house, to the date of sale, 2017, and $140K in 1981 is worth $393K in 2017. So they LOST money.

They were very unhappy with my assessment of their good fortune.

Now my mother spent decades in banking, and she knew exactly what I was saying, but didn't want to hear it. There is a very good reason the Christian church outlawed usury for centuries. And today usury is the basis for our entire economy, and most of the world's economy, and we will suffer from the inherent evils it necessarily entails.

Boomers are not as rich as they think they are. And Millennials and GenZ are not as poor as they think they are.

|

|

|

|

|

|

Orange Beast [6306]

TigerPulse: 100%

40

|

My parents haven't had a mortgage in at least 50 years including

5

5

Nov 18, 2025, 1:26 PM

|

|

vacation homes and they still complain about the price of a meal.

|

|

|

|

|

|

TigerNet Champion [113050]

TigerPulse: 100%

65

Posts: 73083

Joined: 2002

|

Heck, I complain about the price of meals.

2

Nov 18, 2025, 1:59 PM

|

|

And I'm no boomer, Gen X barely.

And don't get me started on cars and TRUCKS.

|

|

|

|

|

|

TigerNet Grandmaster [198407]

TigerPulse: 100%

71

Posts: 39994

Joined: 2007

|

How about them property taxes on vehicles?

1

Nov 18, 2025, 2:01 PM

|

|

they have gone thru the roof.

|

|

|

|

|

|

All-Time Great [94300]

TigerPulse: 100%

63

Posts: 64507

Joined: 2004

|

And boats.

2

Nov 18, 2025, 2:04 PM

|

|

My truck is a 2025 GMC and the property taxes were $968.

My boat is a 2017 22'..and the property taxes were almost $800 this year. The property taxes on my 2008 4runner were $12. I guess in a few years, if we still have it, they may start to go back up when it turns 25 and into an "antique".

Property taxes and insurance are my 2 biggest expenditures behind my house payment. Between flood, auto, boat, and homeowners insurances..I'm $9k a year into it. I'm about $5k a year into house, car(2) and boat taxes.

|

|

|

|

|

|

TigerNet Elite [76716]

TigerPulse: 100%

61

Posts: 17765

Joined: 2018

|

Yeah we are in same boat with boomer parents.

5

5

Nov 18, 2025, 1:08 PM

[ in reply to Fantastic to know. My wife just spent some of our limited disposable income ] |

|

And for the record, I definitely don't 'hate' boomers, or blame individual boomers for their overall inherent advantage of timing.

But it would be cool if some (more) of them recognize what they were gifted and realize we don't necessarily have those advantages.

|

|

|

|

|

|

TigerNet HOFer [124201]

TigerPulse: 100%

66

Posts: 71296

Joined: 2002

|

Oh, I don't hate them either, they took the opportunities they were afforded and

4

Nov 18, 2025, 1:16 PM

|

|

made a life for themselves. Some did much better than others. But...not all Boomers made big money on housing, pensions, etc. Alot of Boomers also don't acknowledge those opportunities and fuck them.

|

|

|

|

|

|

TigerNet Elite [76716]

TigerPulse: 100%

61

Posts: 17765

Joined: 2018

|

Yep, agree. Rising tide didn't float them dinghies like it did the yachts.***

2

Nov 18, 2025, 1:21 PM

|

|

|

|

|

|

|

|

TigerNet Champion [110300]

TigerPulse: 100%

65

Posts: 30788

Joined: 2014

|

But don't we inherit all their stuff?

2

Nov 18, 2025, 1:16 PM

[ in reply to Yeah we are in same boat with boomer parents. ] |

|

I think I'm doing ok saving on my own, but what if a few mill falls into my lap?

I can only be so irresponsible. I may start adding bacon to chocolate-peanut butter pies just because I can!

|

|

|

|

|

|

TigerNet HOFer [124201]

TigerPulse: 100%

66

Posts: 71296

Joined: 2002

|

few mill? Nice

3

Nov 18, 2025, 1:18 PM

|

|

I don't think they all go that way

I can speak from experience, one certainly didn't go that way.

|

|

|

|

|

|

TigerNet HOFer [124201]

TigerPulse: 100%

66

Posts: 71296

Joined: 2002

|

Speaking of STUFF. Pro Tip, it's not worth much and you will spend alot on

4

Nov 18, 2025, 1:20 PM

[ in reply to But don't we inherit all their stuff? ] |

|

a giant dumpster, but it will be worth it.

I hauled so much of my Dad's STUFF to the dump just to get the house and sheds clean

|

|

|

|

|

|

TigerNet Champion [110300]

TigerPulse: 100%

65

Posts: 30788

Joined: 2014

|

I was thinking more about properties and savings

4

Nov 18, 2025, 1:24 PM

|

|

than the glass jars full of screws.

|

|

|

|

|

|

TigerNet Elite [76716]

TigerPulse: 100%

61

Posts: 17765

Joined: 2018

|

|

|

|

|

|

TigerNet HOFer [124201]

TigerPulse: 100%

66

Posts: 71296

Joined: 2002

|

Do you have a collection of old lumber? Some with rusty nails still in it?

5

5

Nov 18, 2025, 1:24 PM

|

|

Covered in mud, vines, snakes, spiders, and kudzu? That was a fun clean-out.

|

|

|

|

|

|

TigerNet Elite [76716]

TigerPulse: 100%

61

Posts: 17765

Joined: 2018

|

Not as much as I would have a few years ago. Actually my parents downsized

5

5

Nov 18, 2025, 1:28 PM

|

|

from a farm with acres and barns full of #### to a small house in town, and mostly they did that because we've been complaining to them for years about the near-hoarding nightmare we are going to be stuck with from my ILs.

But that SOUNDS Like a good time. I would have burned it down.

|

|

|

|

|

|

All-In [10791]

TigerPulse: 100%

45

|

I'm just glad to know I'm not alone ITT.

5

5

Nov 18, 2025, 1:42 PM

|

|

I don't even know how we are going to go through the massive hoards of junk my dad has stuffed in their basement.

My dad had been dead set on moving out to the country and getting a minifarm. Trying to convince him that was a TERRIBLE idea put some strain on our relationship.

My parents actually downsized about 7 years ago. LOL. As the only son, I got to load the stupid scrap lumber into the POD and then unload it at the new house, were it sits outside instead of the basement. That same wood has probably sat at 3 or 4 different houses over three decades because "you never know when you might need it."

I'm currently trying to figure out a time when my dad will be out of the house for a day or two so I can go throw away some of the junk in the basement.

brb, going to go huff some Xanax after thinking about this.

|

|

|

|

|

|

TigerNet Elite [76716]

TigerPulse: 100%

61

Posts: 17765

Joined: 2018

|

Re: I'm just glad to know I'm not alone ITT.

5

5

Nov 18, 2025, 1:44 PM

|

|

|

|

|

|

|

|

All-Time Great [94300]

TigerPulse: 100%

63

Posts: 64507

Joined: 2004

|

|

|

|

|

|

All-Time Great [94300]

TigerPulse: 100%

63

Posts: 64507

Joined: 2004

|

I DO! I DO!

2

Nov 18, 2025, 1:36 PM

[ in reply to Do you have a collection of old lumber? Some with rusty nails still in it? ] |

|

And my parents were technically pre-boomers.

An engineer father with a post great depression hoarder attitude of saving every scrap of junk just in case one day he needed it to "fix" something. We still have most of it strewn across a large 2 car garage.

Add to that my stay-at-home over coddled mother who is bored and has untold thousands in credit card debt from QVC and whatever Wal-Mart crap she could fit in her car. Her house is one big unopened box full of cheap plastic crap. But she has stuffed enough money randomly in some of it to cause us to have to go through every item to find it.

Personally, I'd be just as satisfied to set fire to the whole thing rather than deal with it all, but I'm sure my sisters will complain about that (but not actually lift a finger to assist in the actual clean out).

The only part of all this that is freeing is that when my mother passes away, there won't be anything holding me here any longer.

|

|

|

|

|

|

TigerNet Elite [76716]

TigerPulse: 100%

61

Posts: 17765

Joined: 2018

|

FML do you know how many times they have told us 'don't just throw it all away,

4

Nov 18, 2025, 1:41 PM

|

|

we've got great Uncle Cletus's coin collection in there somewhere'.

|

|

|

|

|

|

TigerNet Champion [110300]

TigerPulse: 100%

65

Posts: 30788

Joined: 2014

|

I bet that's worth at least $134***

3

Nov 18, 2025, 1:42 PM

|

|

|

|

|

|

|

|

TigerNet HOFer [124201]

TigerPulse: 100%

66

Posts: 71296

Joined: 2002

|

I have 1/3 of my Dad's coin collection in my closet now

3

Nov 18, 2025, 1:42 PM

[ in reply to FML do you know how many times they have told us 'don't just throw it all away, ] |

|

Presumably my brothers have the other 2/3

I'd like to sell it and be done with it, but I really have no clue who to go to and what would be a fair price.

My brother took SOME of his and got a couple thousand, but he said it also included his FIL's collection that they inherited as well.

|

|

|

|

|

|

TigerNet Champion [110300]

TigerPulse: 100%

65

Posts: 30788

Joined: 2014

|

JGB will give you a nickel for a penny, I would take it to him

3

Nov 18, 2025, 1:44 PM

|

|

My dad gave me some coins from my grandfather, I looked it up online and it was worth $134.

|

|

|

|

|

|

TigerNet Elite [76716]

TigerPulse: 100%

61

Posts: 17765

Joined: 2018

|

We were given a valuable painting and asked to have it appraised because

4

Nov 18, 2025, 1:47 PM

|

|

some wealthy uncle had bought it as an investment. I was about to take it to an appraiser and pay $500 to have it appraised and then I found the EXACT same painting, except in better condition and it had been sitting unsold on eBay for a couple years at $1200.

|

|

|

|

|

|

All-Time Great [94300]

TigerPulse: 100%

63

Posts: 64507

Joined: 2004

|

True story: I was cutting my mothers grass two weeks ago and my mother came

3

Nov 18, 2025, 1:50 PM

[ in reply to FML do you know how many times they have told us 'don't just throw it all away, ] |

|

outside and stopped me. She stopped me from weed eating to give me 2 nickels. Apparently they are silver or something, and are worth about a $1..EACH. I told her to just hold on to them.

So the next time I have to pay to fix her air conditioner, or pay the taxes and insurance on her house...I'll have $2 in reimbursement.

|

|

|

|

|

|

TigerNet Champion [110300]

TigerPulse: 100%

65

Posts: 30788

Joined: 2014

|

|

|

|

|

|

TigerNet Elite [76716]

TigerPulse: 100%

61

Posts: 17765

Joined: 2018

|

SOME of them did. Some others made a lifetime of terrible financial decisions

3

Nov 18, 2025, 1:30 PM

|

|

to squander that nest egg and then retired decades before they should have.

|

|

|

|

|

|

TigerNet Champion [110300]

TigerPulse: 100%

65

Posts: 30788

Joined: 2014

|

I feel like

3

Nov 18, 2025, 1:34 PM

|

|

poor people are still going to poor and rich people still going to sit in the lower deck.

People will move up and down classes, but it will all balance out until teh Large Hadron collider causes the earth to split in two.

|

|

|

|

|

|

TigerNet Elite [76716]

TigerPulse: 100%

61

Posts: 17765

Joined: 2018

|

Completely agree. Except I'm expecting an asteroid will get us first.

2

Nov 18, 2025, 1:35 PM

|

|

|

|

|

|

|

|

TigerNet Grandmaster [198407]

TigerPulse: 100%

71

Posts: 39994

Joined: 2007

|

Super volcano is on my list for armageddon finale.

2

Nov 18, 2025, 2:22 PM

|

|

And there are plenty of boomers struggling to make ends meet. Just go to the store and see who is bagging your groceries or working the register.

|

|

|

|

|

|

TigerNet Elite [76716]

TigerPulse: 100%

61

Posts: 17765

Joined: 2018

|

100% agree, plenty of boomers didn't get rich.***

1

Nov 18, 2025, 2:35 PM

|

|

|

|

|

|

|

|

Orange Immortal [62354]

TigerPulse: 100%

60

Posts: 25258

Joined: 1998

|

|

|

|

|

|

TigerNet Champion [113050]

TigerPulse: 100%

65

Posts: 73083

Joined: 2002

|

Boomers are not as rich as they think they are. Younger generations are

2

Nov 18, 2025, 1:08 PM

|

|

not as poor as they think they are.

|

|

|

|

|

|

TigerNet Elite [76716]

TigerPulse: 100%

61

Posts: 17765

Joined: 2018

|

Re: Boomers are not as rich as they think they are. Younger generations are

5

5

Nov 18, 2025, 1:12 PM

|

|

|

|

|

|

|

|

TigerNet Champion [113050]

TigerPulse: 100%

65

Posts: 73083

Joined: 2002

|

Re: Boomers are not as rich as they think they are. Younger generations are

2

Nov 18, 2025, 1:57 PM

|

|

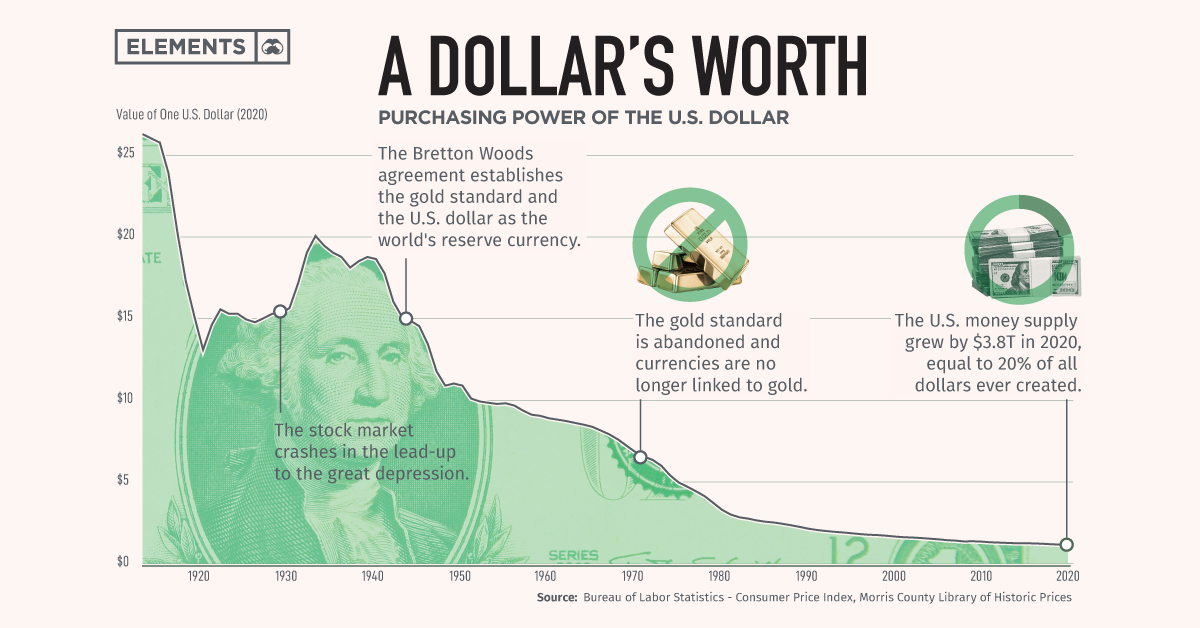

As the purchasing power of the dollar weakens, then value of an asset appears to increase in dollar value, over time, as the dollar buys less and less. So you take a pile of $100 bills in 1960 totaling say, $500,000, lock them in a safe at birth, and in your safe, you have $500,000. You forget about the safe, live your life, and in 2025, at age 65 you open the safe, and you have.....$500,000. Now, in 1960, that $500,000 could have purchased a 20,000 square foot (mansion) on a 20 acre manicured estate. Your $500,000 today, buys you maybe 2,000 square feet of house in a track home development in Eastover, with a postage stamp yard.

Now, let's say you invested that $500,000 in 1960, say you bought Coca-Cola, and held it until today. You sell it, and make $5,400,000. WOAH...NOW we're talking. $500K into $5,400K, WOW. Guess what? The purchasing power of that $5.4 million, today, purchases the SAME stuff the original $500K could purchase in 1960. SO YOU'RE ONLY BREAKING EVEN HERE........

Here's a chart to explain what I mean.

People watch dollar numbers climb, but completely forget the decline in value those dollars have, over time.

Here's another example. I was raised in an upper middle class home. We weren't rich, but we certainly were not poor either. Went to a private school. Large 2-story brick house in a nice neighborhood. My parents income in 1985 was roughly, maybe just a tad shy of $100K a year, household income. NICE income back then, for sure. Probably top 4-5% of household incomes in SC in the mid-1980s. Ok, so today, to MATCH my parents "wealth" due to the decline in the dollar since the mid 1980's, my wife and I would have to have a household income of $301K. My wife and I each make about 3 times as much as any one of our parents made. And yet......our standard of living barely matches what we grew up with. Certainly is not any higher.

|

|

|

|

|

|

TigerNet HOFer [124201]

TigerPulse: 100%

66

Posts: 71296

Joined: 2002

|

|

|

|

|

|

TigerNet Eternal Icon [184684]

TigerPulse: 100%

70

Posts: 50669

Joined: 2007

|

It is rough being a tail end boomer

6

6

Nov 18, 2025, 1:18 PM

|

|

Everybody thinks you got yours but it’s your older cousins who cleaned out the cookie jar.

|

|

|

|

|

|

TigerNet Grandmaster [198407]

TigerPulse: 100%

71

Posts: 39994

Joined: 2007

|

Here's your inheritance

3

Nov 18, 2025, 1:31 PM

|

|

"About one-third of baby boomers’ wealth today is equity in their primary residence" - this ain't real wealth imo until you can liquidate and that means for the heirs.

Unless mom and dad need assisted living, kiss that money goodbye then.

|

|

|

|

|

|

TigerNet Elite [76716]

TigerPulse: 100%

61

Posts: 17765

Joined: 2018

|

Probably TMI but we're looking at one mortgage with little equity and even

5

5

Nov 18, 2025, 1:34 PM

|

|

better, one REVERSE mortgage. Those should be criminal.

|

|

|

|

|

|

TigerNet Grandmaster [198407]

TigerPulse: 100%

71

Posts: 39994

Joined: 2007

|

Just like Medicare Advantage plans

2

Nov 18, 2025, 1:35 PM

|

|

if you got to get Wiliam Shatner to promote, they suck.

|

|

|

|

|

|

All-In [10791]

TigerPulse: 100%

45

|

It will be interesting to look at those valuations with slowing/declining pop.

3

Nov 18, 2025, 1:44 PM

[ in reply to Here's your inheritance ] |

|

Do Gens Alpha/Z/Millennials swarm into those vacated houses? Do they even have the capital for that? Do the houses rot because they are overvalued?

Very interesting to see.

|

|

|

|

|

|

Ultimate Tiger [37213]

TigerPulse: 100%

56

Posts: 18953

Joined: 2014

|

Re: It will be interesting to look at those valuations with slowing/declining pop.

3

Nov 18, 2025, 1:47 PM

|

|

Death - the problem solve for our housing crisis

|

|

|

|

|

|

Orange Immortal [61648]

TigerPulse: 100%

60

Posts: 28769

Joined: 1999

|

Re: It will be interesting to look at those valuations with slowing/declining pop.

1

Nov 18, 2025, 4:20 PM

|

|

|

|

|

|

|

|

All-Time Great [94300]

TigerPulse: 100%

63

Posts: 64507

Joined: 2004

|

|

|

|

|

|

Orange Immortal [60632]

TigerPulse: 100%

60

Posts: 32770

Joined: 2002

|

They don't seem to want to downsize.

1

Nov 18, 2025, 4:49 PM

[ in reply to Here's your inheritance ] |

|

I thought my parents' generation would be relieved to sell their houses, take the loot, and move into a condo or 55+ type neighborhood where they don't have to mow lawns and shovel snow anymore. That's what my grandparents did, but my elderly relatives apparently want to die in houses where they raised their children.

|

|

|

|

|

|

All-Time Great [94300]

TigerPulse: 100%

63

Posts: 64507

Joined: 2004

|

My mother won't leave her place.

1

Nov 18, 2025, 5:15 PM

|

|

She'll die in that place that she's made a prison with a ton of junk surrounding her.

I don't know why people choose to live like that. Were I a single person, I'd have 1 of everything I have 3 of now.

|

|

|

|

|

|

Ultimate Tiger [37213]

TigerPulse: 100%

56

Posts: 18953

Joined: 2014

|

Re: Boomer wealth article in the WaPo today. Relates to our discussion last week or

3

Nov 18, 2025, 1:42 PM

|

|

Wait a minute - I thought everyone in the Jounge was uber wealthy

|

|

|

|

|

|

TigerNet Grandmaster [198407]

TigerPulse: 100%

71

Posts: 39994

Joined: 2007

|

I thought they were uber poor***

3

Nov 18, 2025, 1:52 PM

|

|

|

|

|

|

|

|

TigerNet Elite [76716]

TigerPulse: 100%

61

Posts: 17765

Joined: 2018

|

Everybody is rich when they pick the restaurant, and poor when the check comes.***

4

Nov 18, 2025, 1:59 PM

|

|

|

|

|

|

|

|

Tiger Spirit [10046]

TigerPulse: 100%

44

|

Re: Everybody is rich when they pick the restaurant, and poor when the check comes.***

Nov 18, 2025, 4:50 PM

|

|

Alegator arms

|

|

|

|

|

|

TigerNet Champion [110300]

TigerPulse: 100%

65

Posts: 30788

Joined: 2014

|

|

|

|

|

|

Orange Immortal [61648]

TigerPulse: 100%

60

Posts: 28769

Joined: 1999

|

Re: Lunge lost 25% of wealth

1

Nov 18, 2025, 4:25 PM

|

|

|

|

|

|

|

|

|

|

All-Time Great [94300]

TigerPulse: 100%

63

Posts: 64507

Joined: 2004

|

On the theme of hoarding boomers leaving their treasures to their children...

3

Nov 18, 2025, 1:47 PM

|

|

I'd suggest watching "Harold's Estate" series of videos on youtube:

https://www.youtube.com/@HaroldsEstate

This guy's step father (Harold) was both a hoarder and later had dementia, and spent the last 20 years of his life putting the storyteller's mother tens of thousands in debt financing the accumulation of all his "treasures".

And since he had dementia, Harold thought everyone was trying to steal it all. So he put locks on everything to secure it all. And sometimes put trailers with no wheels in front of those locked doors. And welded big chains welded to railroad car wheels in front of the trailer. All to keep people from stealing his dismantled old motorcycles and vacuum cleaners. Lots of vacuum cleaners.

I don't do it justice, but its a surprisingly entertaining series of videos that eventually makes you think "Well, I don't have it as bad as THAT guy does". I'd wreckermend.

|

|

|

|

|

|

TigerNet Legend [139880]

TigerPulse: 100%

67

Posts: 61983

Joined: 2009

|

Interesting article and discussions

2

Nov 18, 2025, 2:39 PM

|

|

Shannon is 33 years old, Cal Berkley and Columbia schooled - liberal maybe?

Federico -39 year old Futsal player from Italy

|

|

|

|

|

|

TigerNet HOFer [124201]

TigerPulse: 100%

66

Posts: 71296

Joined: 2002

|

Re: Interesting article and discussions

3

Nov 18, 2025, 3:08 PM

|

|

|

|

|

|

|

|

Orange Immortal [66092]

TigerPulse: 100%

60

Posts: 44950

Joined: 1998

|

its sad that schools teach NOTHING about financial competency

5

5

Nov 18, 2025, 3:03 PM

|

|

they teach sociology and psychology and philosophy and the other touchy-feely abstract concept humanities, but don't even bother to teach REAL-WORLD stuff, things that every human being on Earth needs to know, and cannot escape - money budgeting and finances. If you're lucky, you might get a Econ class or two, but that's about it if you aren't a Business major.

I know so many people, friends, relatives, women I have dated, that have ZERO concept of how to handle money. Fortunately my parents taught me how to spend vs. save money and the discipline it takes to make financial decisions. But many many people aren't that lucky and have nobody to teach them the value of a dollar. It's really not that hard if you learn the basics, you don't have to be a MBA.

But you MUST be educated or you'll never ever grasp it, and that means a life destined for poor decisions and tragic outcomes.

|

|

|

|

|

|

TigerNet Legend [139880]

TigerPulse: 100%

67

Posts: 61983

Joined: 2009

|

Point i tried to make last week

3

Nov 18, 2025, 3:08 PM

|

|

But so many excuses…

|

|

|

|

|

|

TigerNet HOFer [124201]

TigerPulse: 100%

66

Posts: 71296

Joined: 2002

|

Re: Point i tried to make last week

3

Nov 18, 2025, 3:09 PM

|

|

|

|

|

|

|

|

TigerNet Legend [139880]

TigerPulse: 100%

67

Posts: 61983

Joined: 2009

|

Which one is you?***

2

Nov 18, 2025, 3:17 PM

|

|

|

|

|

|

|

|

Orange Immortal [66092]

TigerPulse: 100%

60

Posts: 44950

Joined: 1998

|

|

|

|

|

|

TigerNet Elite [76716]

TigerPulse: 100%

61

Posts: 17765

Joined: 2018

|

|

|

|

|

|

Orange Immortal [66092]

TigerPulse: 100%

60

Posts: 44950

Joined: 1998

|

and that's criminal

4

Nov 18, 2025, 3:26 PM

|

|

you couldn't solve poverty overnight or anything, but if every highschooler had to take one finance class per year, this would put a huge positive dent in the struggling household statistics.

Once you learn about money and saving, for many people it gets addictive, and becomes a life long quest to save and accumulate for a future day. Save $5 a day, or $50 a week, or $100 a month, invest it in something and watch it grow. It's so much easier to buy funds or stocks today than it was 30 years ago. No excuse that everyone isn't doing that in some minimal way.

Instead, most people waste what they have on whims and urges, Starbucks and Door Dash. A truck 3 times bigger than what they need, 4WD when they never venture off city pavement. 50 pairs of shoes, or purses they don't need. A McMansion where they don't even use 3 of the rooms they pay out the nose to heat and cool. Save half of that instead of blowing it on dopamine hits, and their retirement would be set.

|

|

|

|

|

|

TigerNet Legend [139880]

TigerPulse: 100%

67

Posts: 61983

Joined: 2009

|

They talk simple household finance tips

Nov 18, 2025, 3:47 PM

|

|

On the Today Show

50% take home for necessities

30% for wants

20% savings

It aint rocket science

|

|

|

|

|

|

Orange Beast [6306]

TigerPulse: 100%

40

|

Not sure about SC, but here in FL my freshman is required to take

1

Nov 18, 2025, 3:51 PM

[ in reply to its sad that schools teach NOTHING about financial competency ] |

|

a financial literacy course to graduate from high school.

topics she's covered recently are credit, bank statements, resumes, career/job/college research, health insurance, budgeting, meal planning

|

|

|

|

|

|

Orange Immortal [66092]

TigerPulse: 100%

60

Posts: 44950

Joined: 1998

|

that's great - article I posted above says some states are now requiring finance

1

Nov 18, 2025, 4:06 PM

|

|

classes in HS.

That's a resource that a kid can use his/her whole life no matter what kind of career they pursue.

|

|

|

|

|

|

Orange Immortal [60632]

TigerPulse: 100%

60

Posts: 32770

Joined: 2002

|

Ok sure but that's not the point.

1

Nov 18, 2025, 4:15 PM

[ in reply to its sad that schools teach NOTHING about financial competency ] |

|

My parents' first house was purchased for $60k in 1976. Adjusting for inflation, that house should be worth about $345k today. That house sold for $650k in 2020 and the current estimate is that it's worth over a million dollars. No amount of financial literacy can fix that, especially when college degrees aren't worth much anymore and college tuition is crazy expensive.

As pissed as I was last week, I'm not affected by this nearly as much as Millenials and Gen Alpha. I bought my first home in 2009 and my wife and I bought our current house in 2021. We're comfortable, we've made good choices, and we're in a great position.

What drives me crazy is these rickity old know-it-alls in their recliners talking about how kids today are too lazy to pull themselves up by their bootstraps. To the point of the article in the original post, Baby Boomers have lived through a period of prosperity and affordability that no longer exists and they apparently can't fathom that their children and grandchildren are facing challenges and barriers that they never encountered.

You can't flip burgers to pay for college anymore. A couple in their 20s with two kids can rarely afford a four bedroom house. Anyone who is financially literate should know that.

|

|

|

|

|

|

All-Time Great [94300]

TigerPulse: 100%

63

Posts: 64507

Joined: 2004

|

The "stop buying coffee" group are the ones that get me.

Nov 18, 2025, 5:13 PM

|

|

It's being both completely out of touch while simultaneously being arrogant about it.

I'm an old mfer and there's no way I'd want to be going through that ish now. I never thought I'd say I'm glad to get old, but I kinda am.

|

|

|

|

|

|

Replies: 83

| visibility 3061

|

|

|