|

Replies: 18

| visibility 609

|

Oculus Spirit [97703]

TigerPulse: 100%

Posts: 64842

Joined: 7/13/02

|

History is about to repeat itself. You'd think people would

Feb 10, 2019, 1:39 PM

|

|

Be more mindful.

https://www.seattletimes.com/business/wealth-concentration-near-levels-last-seen-during-the-roaring-twenties-study-finds/

The "wealth" gap is not as big as people think. Most is accounted for in stock prices. And that's nothing more what people think that company is worth. When, not if, the larket crashes that gap closes big time. Same exact thing happened in the roaring 20s. If Bezos had a meltdown, tried to sell all his Amazon stock and go live in a hut in Tahiti.... He'd get pennies on the dollar in his firesale. Company would become relatively worthless overnight. And everyone from the mechanic who had a 401K to billionaires will crumble.

It all begins with economic growth and or inflation. That raises the cost of debt. Debt becomes a liability instead of an asset. Many companies floating in debt will tank. It's all dominoes. Actually stocks will be the least concern.

|

|

|

|

|

Lot o points [155796]

TigerPulse: 100%

Posts: 65777

Joined: 5/6/13

|

Speak for yourself.

Feb 10, 2019, 1:50 PM

|

|

My mattress is stuffed with gold doubloons. It’s super lumpy, but I sleep well.

|

|

|

|

|

|

CU Medallion [50635]

TigerPulse: 100%

Posts: 43019

Joined: 12/3/98

|

Re: Speak for yourself.

Feb 10, 2019, 1:58 PM

|

|

|

|

|

|

|

|

Oculus Spirit [97703]

TigerPulse: 100%

Posts: 64842

Joined: 7/13/02

|

Just saying a lot of factors are VERY similar

Feb 10, 2019, 2:12 PM

|

|

This wealth gap is based mostly on stock values. And those are by no means set in stone. And don't get me started on derivatives. That's even worse.

|

|

|

|

|

|

CU Medallion [60033]

TigerPulse: 100%

Posts: 22495

Joined: 5/24/17

|

Re: Speak for yourself.

Feb 10, 2019, 4:34 PM

[ in reply to Re: Speak for yourself. ] |

|

Kiyosaki just seems like a fake name. Like I tried to pull off being Japanese. That’s something I would have come up with.

|

|

|

|

|

|

Oculus Spirit [97703]

TigerPulse: 100%

Posts: 64842

Joined: 7/13/02

|

Sounds like a brand name for a rice rocket.***

Feb 10, 2019, 4:45 PM

|

|

|

|

|

|

|

|

CU Medallion [50635]

TigerPulse: 100%

Posts: 43019

Joined: 12/3/98

|

his first name is the 1 that really screams japanese***

Feb 10, 2019, 4:50 PM

[ in reply to Re: Speak for yourself. ] |

|

|

|

|

|

|

|

Lot o points [155796]

TigerPulse: 100%

Posts: 65777

Joined: 5/6/13

|

|

|

|

|

|

CU Medallion [60033]

TigerPulse: 100%

Posts: 22495

Joined: 5/24/17

|

Re: Speak for yourself.

Feb 11, 2019, 10:20 AM

|

|

Amazing find and I totally forgot about that scene. Obed®

|

|

|

|

|

|

Lot o points [155796]

TigerPulse: 100%

Posts: 65777

Joined: 5/6/13

|

You can always tell the true SaTB aficionados

Feb 11, 2019, 10:22 AM

|

|

We gladly suffer through both sequels just to watch Buford T Justice.

|

|

|

|

|

|

CU Guru [1907]

TigerPulse: 90%

Posts: 3154

Joined: 11/11/17

|

Re: Speak for yourself.

Feb 11, 2019, 9:09 AM

[ in reply to Re: Speak for yourself. ] |

|

Depends if it saved in hard assets or Fiat currencies in truth.

|

|

|

|

|

|

All-In [42132]

TigerPulse: 100%

Posts: 38223

Joined: 11/30/98

|

Oh please...

Feb 10, 2019, 3:24 PM

|

|

My wife would have Amazon back on its feet in no time with all the #### she buys online.

|

|

|

|

|

|

Oculus Spirit [97703]

TigerPulse: 100%

Posts: 64842

Joined: 7/13/02

|

They will never realize their $800B market cap

Feb 10, 2019, 4:57 PM

|

|

Your wife, mine, and 50 million others notwithstanding. Same for Apple or Google.

Sure, it's worth billions. Maybe even a hundred billion. NOT $800 billion. You can't GET $800 billion out of Amazon. They won't MAKE $800 billion. Just last year, for the FIRST TIME, Amazon topped $2 billion in profit. T. W. O. If your market cap is profit X 400 then that seems perfectly reasonable. String together 400 years of years like 2018 and you're set. Point is everything is fine until it isn't. Bezos' gains and loses more "wealth" in a day than I will ever make in my life. That's fine. At the end of the day, it's all based on stocks. He can't ever realize the full current market value for his stock. Yet that's counted into his net "worth", even though there's absolutely ZERO way he could ever get money (or any other asset) of equal value from his stock holdings. He knows this. Everyone knows this. Yet people think he's "worth" $50 billion +. He isn't. He's worth only the amount of money people want to give him for his assets. He sells ALL of his stock, there's an oversupply, market tanks, everyone gets scared to buy Amazon, and he gets pennies on the dollar.

Same for real estate. Zillow, realtors, appraisers, whatever say your house is "worth" whatever. Until someone PAYS you whatever, it's a house. Now they can come a lot closer with real estate than with stocks because it's a much more stable market.

|

|

|

|

|

|

All-In [31887]

TigerPulse: 100%

Posts: 37176

Joined: 11/22/03

|

The $2B was quarterly profit, not annual...

Feb 11, 2019, 7:32 AM

|

|

P/E ratio is about 78 for Amazon stock.

Still very high P/E and your overall point is still somewhat valid, but it's not a multiple of 400 (since most of these conversations are based on annual profit and not quarterly profit).

Also, Bezos selling his stock in the open market is not the only way he can turn stock into cash...he could also sell the company to another company or group of investors, which is about the only way something that large could happen without tanking the stock price.

|

|

|

|

|

|

Orange Blooded [2692]

TigerPulse: 97%

Posts: 3411

Joined: 7/3/07

|

Money is chased behind the corporate veil

Feb 10, 2019, 4:49 PM

|

|

At their height in the 1950's, individual tax rates on the wealthiest used to average 77% and even peaked at 93%. Then we ushered in the era of corporate tax shelters, the creation of new entities like the LLC, the C-Corp and the S-Corp, which allowed entrepreneurs the ability to shield income from the highest tax rates on individuals.

Income from business profits are funneled into trust accounts, real estate, and invested in other income producing assets. Tax policy has caused a sophisticated shell game, allowing individuals and families who control businesses the ability to avoid the higher tax.

It should be pretty obvious that the American game is ultimately set up to reward successful entrepreneurs, and we have devised a system that allows people like Jeff Bezos, Bill Gates, and Warren Buffet massive opportunities to build equity with the least amount of tax burden.

Reminds me of a great tweet from Naval Ravikant:

"You’re not going to get rich renting out your time. You must own equity - a piece of a business - to gain your financial freedom"

https://twitter.com/naval/status/1002103360646823936

|

|

|

|

|

|

Oculus Spirit [97703]

TigerPulse: 100%

Posts: 64842

Joined: 7/13/02

|

The income tax rate matters little to the super rich

Feb 10, 2019, 5:11 PM

|

|

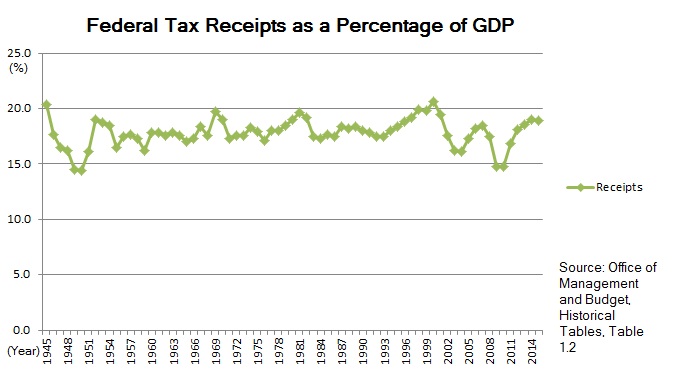

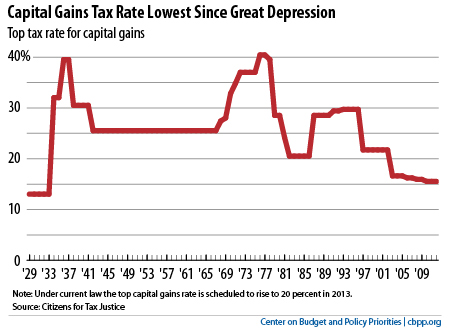

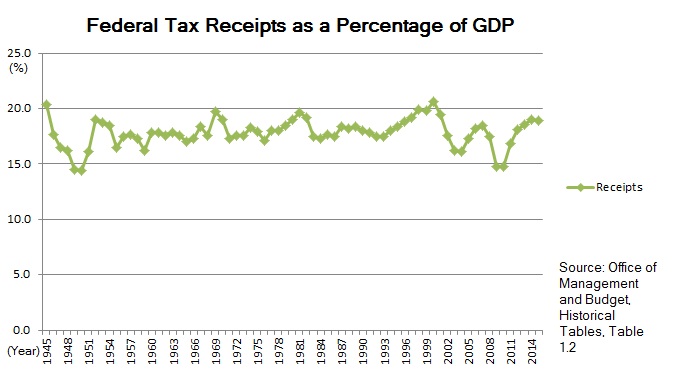

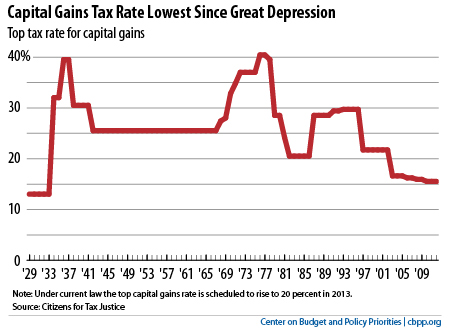

With their assets tied in stocks, for example, their effective income tax rate for selling their stocks is capped at 15%. CEO's are paid a few hundred thousand in salaries, then millions in stock options. Here's another shocking chart......pay close attention to this. Federal revenues have ALWAYS averaged between 15-20% of GDP. No matter the top marginal rate. 90%. 35%. No difference.

Nope. You can tax the super rich at 90% and there will be no windfall of money.

Here's another interesting chart...

|

|

|

|

|

|

Legend [18018]

TigerPulse: 100%

Posts: 30150

Joined: 9/9/06

|

|

|

|

|

|

CU Guru [1907]

TigerPulse: 90%

Posts: 3154

Joined: 11/11/17

|

Re: The income tax rate matters little to the super rich

Feb 11, 2019, 9:12 AM

[ in reply to The income tax rate matters little to the super rich ] |

|

Actually NOBODY paid the published rates in the 1950's and net effective Federal tax rates are roughly the same today as in the 1950'S on all incomes. This is always left out when discussing those rates of taxation as the deductions available then were FAR greater.

|

|

|

|

|

|

110%er [6101]

TigerPulse: 85%

Posts: 10117

Joined: 11/1/11

|

1300 people control 80%+ of the worlds wealth***

Feb 10, 2019, 7:56 PM

|

|

|

|

|

|

|

|

Replies: 18

| visibility 609

|

|

|

to award

the award.

to award

the award.